Portfolio Program

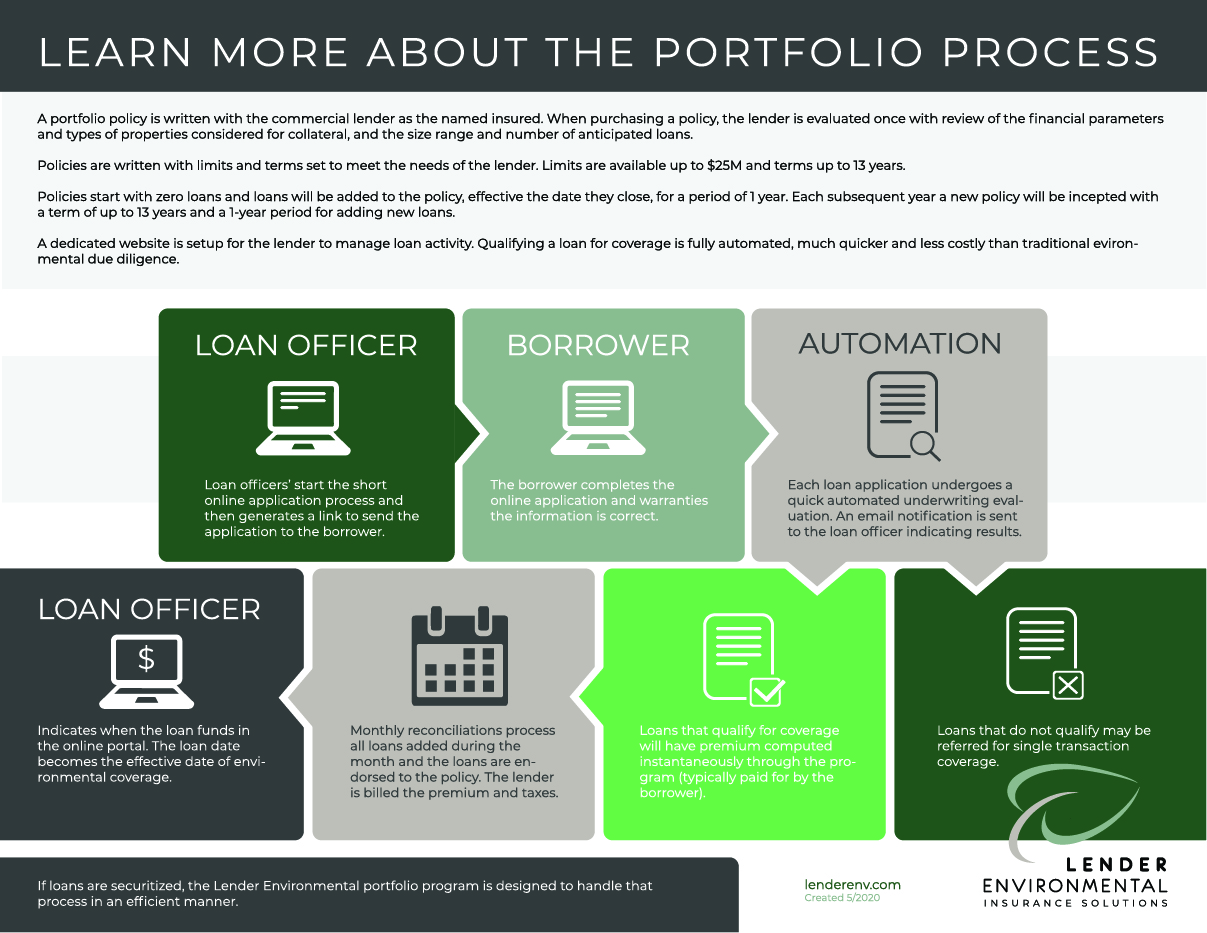

Lender Environmental portfolio policies can provide commercial lenders with an efficient and cost-effective way of addressing environmental due diligence and risk transfer for many of their loans. Under a portfolio policy, the lender is the named insured and coverage is typically paid for by the borrower. Qualifying a loan for coverage is fully automated, much quicker and less costly than traditional environmental due diligence. Coverage for each loan is added effective the loan closing date through a monthly reconciliation.

Submissions and inquiries can be sent to: info@lenderenv.com

LEIS Lender Portfolio Program

LEIS developed a state-of-the-art Lender Environmental portfolio product. Leveraging our own technology, we built an online system that automates and efficiently handles all aspects of the program. The end result is a very efficient and competitive way for commercial lenders to address environmental liability on a large number of their commercial loans.

Program Highlights

- Available exclusively through LEIS, the program manager

- A fully automated program run through a dedicated website through a secure portal for each portfolio client

- Updated in real time so each portfolio client has access at any time to view loan activity

- Management of loans including adding, funding, reconciliation and securitization fully online

- Customizable on policy limits and terms to meet the needs of each lender

- Available with limits up to $25M and terms up to 13 years

- Can accommodate securitization of loan portfolios

- AM Best “A” rated carrier

- Direct bill